Russell Group responds to 2024-25 maintenance loan increase

25 January 2024

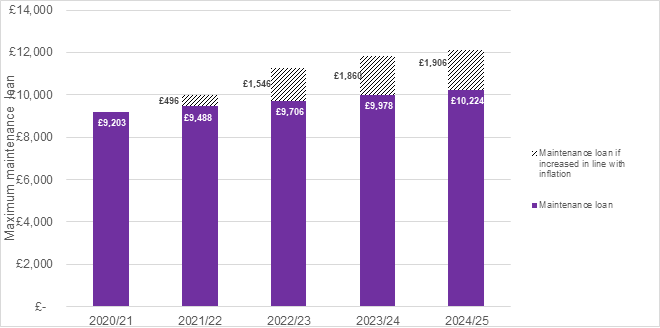

The Department for Education announced today (Wednesday 25 January) that maintenance loans for students in England will be uprated by 2.5% for 2024-25. The announcement comes as students face continuing financial pressures while the cost-of-living remains high, compounded by shortfalls in maintenance loan provision that has failed to keep up with inflation in recent years.

Responding to the announcement, Joanna Burton, Head of Policy for Higher Education at the Russell Group, said:

"Once again, we are disappointed to see that there has been no move to correct the maintenance loan shortfall suffered by students in recent years. Inflation may now be slowing down, but today’s announcement fails to address the deficit that has been created across the last three years.

"Our analysis reveals that upping maintenance support by just 2.5% will leave students in England almost £2000 worse off next year than if the Government had increased loans in line with inflation since 2021-22. We know that a quarter of students regularly go without food and other necessities due to financial hardship, and it’s vital they are provided with adequate loan provision so they can afford the essentials and focus on their studies.

"Russell Group universities have spent tens of millions from their existing budgets on additional support measures over the past year, but it’s not feasible for universities to plug the gap in maintenance provision on their own. The hardest hit will be the most disadvantaged students, who are most at risk of dropping out due to financial pressures, so this decision by Government risks undermining the sector’s efforts to widen access to higher education. We continue to call on the Government to reassess the way maintenance loans are increased to reflect actual and historic average inflation each year, and provide students with the financial backing that they need."

For more details, see the full Russell Group briefing on Cost-of-Living Support For Students.

Notes to editors

- Accounting for the newly-announced uplift, a full-time student living away from home outside London will receive £10,244 per year, leaving them £1,906 short of the £12,130 the loan would be if the Government had raised it in line with inflation since 2020/21 (see graph).

- This shortfall is compounded by the freeze on the parental earnings threshold used to calculate maintenance loans in England, which has been frozen in cash terms since 2008. Students are eligible for the maximum level of maintenance support if their parental earnings are below £25,000. Had this threshold increased with earnings, it would now be closer to £35,000.

- Recent analysis also shows that Russell Group universities spent tens of millions of pounds from existing budgets on financial and non-financial support for students, to assist them with cost-of-living pressures. This provision includes bursaries and hardship funds, food banks and pantries, subsidised meals and travel, and trained money advisors.

-

Laura Peatman

laura.peatman@russellgroup.ac.uk

020 3816 1318

-

Maddy Godin

X

X